Trading With Support and Resistance

All markets and investment tools have prices where they have made turns in the past. If you are to be a profitable trader, you must know what these are and how to recognize them. Depending on your strategy, Support or Resistance will likely be the points at which you might enter or exit a trade. Not all levels are Critical Price Points, however all Critical Price Points are either levels of Support or Resistance.

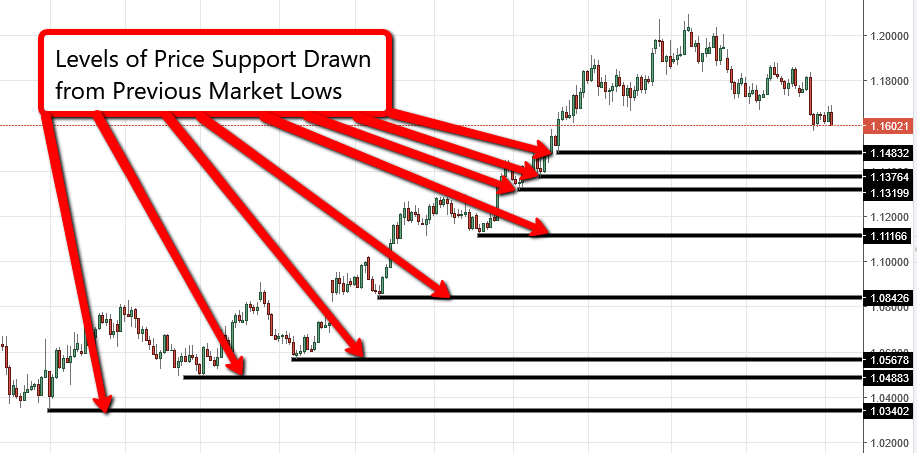

PRICE SUPPORT

Producers that sell products do not want to lower their prices; However, markets are competitive, and if those producers refuse to lower prices for long enough, then their competition will. These price levels can be found easily by drawing a line for former low prices. Here is what this looks like:

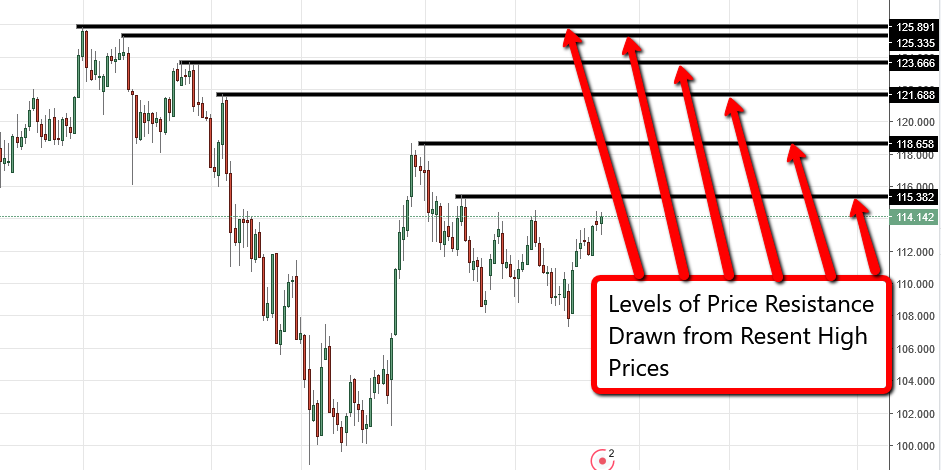

PRICE RESISTANCE

Consumers in a marketplace like to buy things where they are comfortable they always want lower prices. However, if prices increase they may decide to go somewhere else if they can find a comparable product at a lower price. These consumers have a finite amount of capital to spend and want as much value from it as possible. For this fundamental reason, the market will create highs at specific prices. These price levels can be shown by drawing a line from previous highs. This is what it looks like:

What Price Levels are Critical Price Points?

As shown above, there are many levels of Price Support and Price Resistance. Many of these levels will present opportunities, some better than others. The strongest levels of Price Support and Price Resistance are referred to as Critical Price Points.

Price can only go so low, or high, before hitting a Critical Price Point. Price cannot fall below and support profits without a major market change. When prices get high enough, critical decisions will be made as well. Each of these situations promote a market turn, which is where traders will look to begin entering the market.

These prices are often found in places like and “X-Year High” or “Record Highs”. If you are looking at an instrument that has been around for decades (such as any major currency), the levels that the market reached before or during the “last crash” or major market event (such as the 2008/2009 crash).

Critical prices are where, historically, major institutions have changed their tune and the market has made big turns. You will only be able to find these levels of support if you are looking at higher time frames, such as the weekly or monthly charts.

CONCLUSION

The Forex is an incredibly large, macro market that moves about $5.6 Trillion per day. The most important price points are not hit multiple times a day or even each day. The traders that are patient enough to wait for these most important, critical price points, are the ones that will have the potential to make the most profit.